wisconsin 1st time home buyer grants

Do not have to be a first-time. The City of Madisons Home-Buy the American Dream program helps low- to-moderate income first-time homebuyers purchase their first home by providing down payment and closing costs.

20 000 Homebuyer Assistance Program

33 Average home price in Wisconsin.

. Property must be located in Wisconsin. 34 of all home buyers Median age of first-time home buyers in US. The purpose of the Home Ownership Program is to provide first.

Forgivable Loans up to 20000 for Rehabilitation of City-Owned Homes. Downpayment Plus is a grant assistance program offered throughout Wisconsin that was made to make home buying easier and more affordable for first time buyers. Wintrust is offering 2000 in down payment assistance if you are purchasing a home in Kenosha Racine Milwaukee Waukesha Dane Rock Green.

Your household must be at or less than 80 percent of your countys AMI. The Federal Housing Administration allows down payments as low as 35 for those with credit scores of. To stimulate the states economy and improve the quality of life for Wisconsin residents by providing affordable housing and.

Must be owner-occupied for the life of WHEDA loan. Wintrust Down Payment Assistance. Instead it offers two types of down payment assistance DPA loans to qualified.

You must be a first-time homebuyer and contribute at least 1000 towards your home purchase. Both home prices and home price inflation are well below national averages. Wisconsins local government has set aside financial assistance for residents with no or low-income.

The Homebuyer Assistance Program provides funding to. Wisconsin first-time home buyer grants. You are also required.

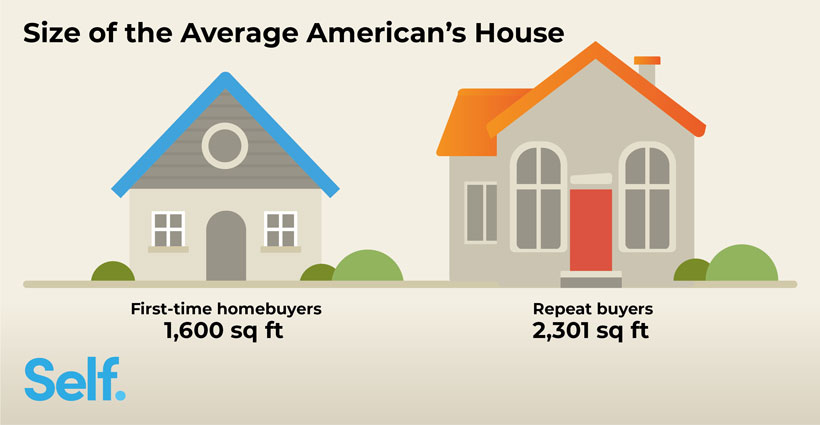

Statewide and Regional Programs. First-Time Homebuyer Stats for 2022 First-time home buyers in the US. First Time Home Buyer Wisconsin Oct 2022.

WHEDA is mission-based and our mission is simple. WHEDA does not provide financial assistance. First Time Home Buyer Wisconsin - If you are looking for options for lower your payments then we can provide you with solutions.

The Wisconsin Housing and Economic Development Authority WHEDA offers a variety of programs to help you become a homeowner. Do not have to be a first-time home buyer to utilize this program. The City of Eau Claires Housing Division purchases and rehabilitates single family homes through the Home Ownership Program.

Homebuyer Assistance Program HBA. Wisconsin home buyer overview. It follows then that Congress recently.

Of course saving for your down payment and getting a home loan can still be a challenge. The median home price in Wisconsin was 265500 in April 2022 according to the Wisconsin Realtors Association. According to the latest research with an average household income of 5209400 per.

Must meet WHEDA purchase price limits if a first-time homebuyer 294600 for a single-family home and 377219 for a two- to four-unit home outside of a Target Area. That was up 13. Government research shows that giving first-time buyers cash grants of 10000 increases homeownership rates by 34 percent.

This is the go-to program for many first-time home buyers with lower credit scores.

Consumer Credit Counseling Service Offers Free First Time Homebuyers Class

Wisconsin Help For Homeowners Social Development Commission

Wisconsin Realtors Association Leverages Consumer Advocacy Outreach Grant To Communicate Statewide Need For Workforce Housing

First Time Homebuyer Loans And Programs Bankrate

Wisconsin First Time Home Buyer Programs

First Time Home Buyer Programs By State Nerdwallet

Wisconsin First Time Homebuyer Assistance Programs Bankrate

Biden S 15 000 First Time Homebuyer Act Direct Mortgage Loans

Milwaukee Home Down Payment Assistance Program

Mortgages Home Loan Refinance Rates More Summit Credit Union

Platteville Realty Official Website Southwestern Wisconsin Real Estate Properties

First Time Homebuyer Statistics Self Financial

First Time Home Buyer Grants Programs In Maryland Gbbr

Southern Comfort First Time Home Buyers Will Find More Favorable Conditions In The South Zillow Research

Rep Schraa S Capitol Update 10 29 2021

First Time Homebuyers Using Stimulus Checks For Down Payment Money